ECONOMY

Financial Inclusion: On the path of realization

In a recent interview to prof. Nicholas Stern in New Delhi, PM Modi emphasised the need to rethink on development beyond the narrow economic and financial sense and more holistically about sustainable, inclusive, and resilient growth that includes human development.

In this brief article, it is proposed to review the financial inclusion efforts in the light of RBI Annual Report 2022.

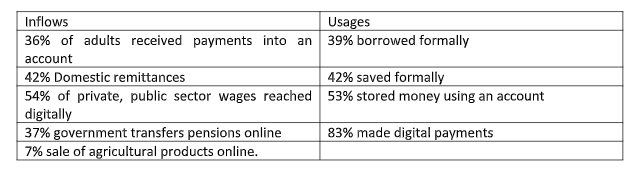

In a blog put out by the World Bank (worldbank.org/all about finance/blog) inflows and usages illustratively affirms the achievements of financial inclusion, mentioning that 71 percent of adults in developing economies have an account.

RBI constructed a composite Findex and tracked the milestones of financial inclusion and financial learning. 2021 agenda is a continuation of the effort in financial inclusion from 2005.

The real instrument for giving a big push came with the opening of Jan Dhan Account, introduction of mobile link to the accounts through Aadhar (JAM), opening no-frills accounts were all the initiatives of the Government in the financial sector, that the RBI cannot take credit for. The single factor responsible for India ranking high in financial inclusion is technology, low cost network availability and easy availability of mobile phones that include smart phones. 2.5lakh villages have been provided broadband connectivity.

Payment options became easier and convenient, thanks to the National Payment Corporation of India’s Unified Payment Solutions (UPI). Every Bank started mobile instrumentality for payment solution followed by NBFCs and FINTECHs.

All this was possible because of the aggressive efforts of the government in ensuring digital penetration that saw street vendors taking payments through the PAYTM QR code. Out of 140crore population, 110crore use mobile phones. 6.8crore have bank accounts and 64.67 percent use omnichannel for their online spending. National E-governance Division’s Rapid Assessment System, Public Fund management, Single Nodal Account, and Bharat Bill Payment System (NPCS-owned) ensured that the Direct Benefit Transfers to the farmers, pensioners and others receiving incentives reached in time.

Government of India and RBI together have saved the cost of delivery of incentives and reduced corruption at the delivery points of the government benefits. It annulled the statement of Rajiv Gandhi once made mentioning in a meeting in Orissa that only 16 percent of the intended benefits under the government schemes reached the intended. Yet, ‘the task of financial inclusion is onerous, but is, by no means, insurmountable’, to quote Deepak Mohanty’s Financial Inclusion Committee Report of Deepak Mohanty.

Shaktikant Das as Governor took the initiative of putting in place a national strategy for FI that included building a composite index for financial inclusion, FI-INDEX. According to RBI Annual Report, 2022, “The annual FI-Index for the period ending March 2021 stood at 53.9 as against 43.4 for the period ending March 2017, capturing the progress made in this area. The FI-Index will be published annually in July every year.” It also claims a number of initiatives taken towards strengthening financial inclusion.

According to the Report, the key achievement under NSFI during the year was ensuring the availability of a banking outlet within a 5 km radius of every village/hamlet of 500 households in hilly areas, in 99.94 per cent of the identified villages. Data in the Annual Report shows that village branches came down by 2751 during the calendar year 2021. Business correspondents (BCs) in villages with population below 2000 also came down by 18,429. Banking outlets in villages in other modes also came down by 922. Thus, the reach to the people in general suffered during this pandemic year.

Its efforts in financial learning through Centers of Financial Learning and workbooks on financial literacy through schools for classes VI-X initiated by Duvvuri Subba Rao as RBI Governor, seem to have laudatory effect going by the increase in the number of Basic Savings Bank Accounts both online and offline.

Disappointing Credit

Credit as medium of financial inclusion leaves several gaps to conclude that the FI-Index increase reflected reality. Priority sector credit, by itself, is no clear indicator of financial inclusion in as much as number of accounts does not reflect the number of either farmers covered, or number of micro and small enterprises covered. There is no data in the report on the number of marginal, small and tenant farmers financed. Priority Sector Lending Certificates (PSLCs) is a shadow achievement in the sector while the window from Small Finance Banks (SFBs) to NBFC-MFIs and MFIs (Trusts and Societies) could reflect true inclusive finance reach expansion as the per capita lending to their clients cannot exceed Rs.25lakhs. Details of E-Negotiable Warehouse Receipts do not give data on the reach of this instrument to the marginal and small farmers. The number of KCCs are part of agricultural credit total given in the priority sector dispensation.

Deepak Mohanty Committee felt that MSMEs are the best vehicle for inclusive growth, job creation and poverty alleviation. While the poverty has been reduced to 15 percent in 2021 according to the OECD report from 26 percent a decade ago, notwithstanding various policy support measures for MSMEs, access to adequate credit still remains elusive for them as revealed by the following table.

RBI reasons out that the decline in number of accounts is due to mandatory registration by Udyam portal of the Ministry of MSME, GoI. Each enterprise can have more than two accounts, both under the category of investment credit and working capital credit. After Atma Nirbhar Bharat Abhiyan, the number of accounts may have gone up for the same enterprises!! The rationale therefore looks peculiar as there is no mention of the number of enterprises financed by the banks but only number of accounts.

Looking at the increase in lending to micro and small versus medium-sized enterprises, it would be presumptuous to say that banks efforts towards financial inclusion have been exemplary. The other instruments of inclusion are MUDRA loans, loans to street vendors, and the extent of credit guarantee scheme as measures to accelerate credit to the micro enterprises and these accounts are all part of the micro category in the table. It is not, however, clear about the number of manufacturing micro and small enterprises financed.

The most significant effort of the RBI is expansion of the CFL project by setting up 1,199 Centers for Financial Literacy (CFLs) covering 3,592 blocks across the country and increasing financial education levels across the country. The other significant achievement is in the area of strengthening digital infrastructure by way of institutionalising the Payment Infrastructure Development Fund (PIDF), launch of Digital Payment Index (DPI), implementation and scaling up the pilot project on expanding and deepening of digital payments ecosystem and laying of Optical Fibre Cable (OFC) under the Bharat Net project of the Government of India (GoI) to provide broadband connectivity to all 2.5 lakh Gram Panchayats across the country. The Sachet Portal covering all the regulators as a grievance redress mechanism does not have any data to support the claim in the Report.

IV.1 Cooperative Banks both in the urban and rural areas have a significant capacity to enhance the financial inclusion effort and they should be supported through counselling, mentoring and follow-up by the regional offices of the RBI.

IV.2 The outcome is good, but the output requires much more effort at the ground level, both by the commercial banks, Regional Rural Banks, SFBs, and BCs. It is high time that RBI improves the data on financial inclusion efforts more in terms of number of persons than in terms of number of accounts.

IV.3 The author is a former senior banker, economist, and risk management specialist. The views are personal.

DISCLAIMER

Views expressed above are the author's own.

START A CONVERSATION